Long-Term Thinking is Key in this Business

Apartment investing is not for the faint of heart or for those in the grip of market swings.

We’ve had a glorious but volatile run over the last few quarters. Amazing deals have popped up seemingly out of nowhere: one proceeded smoothly through raising capital and closing on time, and others…well, they disintegrated before our very eyes. Real estate investing can go from very exciting and rewarding to very expensive and frustrating in the blink of an eye. However, just as there are highs and lows in any business, you can get through it all if you keep your thinking long-term.

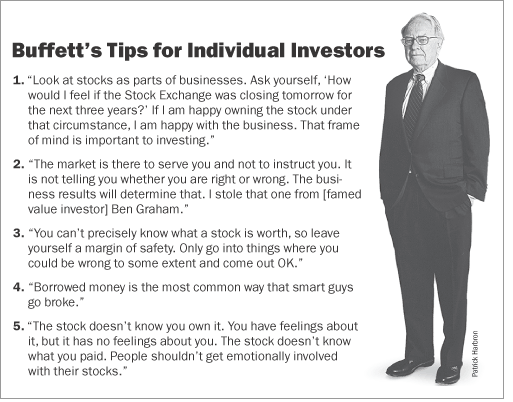

Warren Buffett often makes the point that he prefers to invest for the long term, to buy businesses that are run excellently and are positioned to continue to do so for a long time. That’s the approach I like to take to keep me from losing my mind with the market and interest rate volatility we have seen over the last few years. I try to remove as much short-term risk as possible by opting for longer-term, fixed-rate loans and being prepared to operate every property longer than the business plan. We talk a lot about conservative underwriting for a reason. If everything needs to go right for an investment to be profitable, it becomes extremely vulnerable any time the market is more volatile. That’s not something I’m interested in, and I’m definitely not interested in risking my investors’ dollars on something subject to such risks.

The long-term method of apartment investing is actually quite simple. Find properties that are not producing market rate rents for myriad reasons, and buy them at a discount to market prices with the longest-term debt feasible. From there, solve the problems and raise rental rates to market. This forces appreciation in the value of the property, independent of any market fluctuations. If I can do that with any property in a strong growth market, I will have the margins to operate that property as long as I need to in order to outlast any wild negative market swings. That’s the long-term thinking. Sure, prices may shoot up at an opportune time and add a great amount of value to a property, but I don’t depend on that for an investment to be profitable. Market swings in our favor are just icing on the cake.

Trying to time the market can almost feel like day-trading stocks. It’s frantic, can be very profitable, but can also be devastating. Warren Buffett eschews that type of investing behavior because so much is out of his control. He’s got a pretty good track record. CVI aims to mirror that patient, even “boring,” approach to building wealth for our investors. Our investors let me and our team deal with the crazy and unpredictable swings in the multifamily market. They know that if I bring them an opportunity, it’s been given the Warren Buffett treatment. I’m confident that the opportunity can withstand whatever the world throws at it in the short term and will emerge successful in the long run.

It’s what I do with my own money; why would I treat someone else’s any differently?

-Matthias

P.S. I get asked all the time by eager newbies how to get started investing in real estate. I love answering that question and helping people begin their journeys, but it hit me that I can answer that question faster and for a lot more people if I wrote it all down. I’ve finally done it, and soon we’ll be releasing a FREE Beginner’s Guide to Real Estate Investing. Stay tuned!